Denmark Israel Tax Treaty

Once in force treaty will replace the former. This includes negotiating and bringing into force New Zealands.

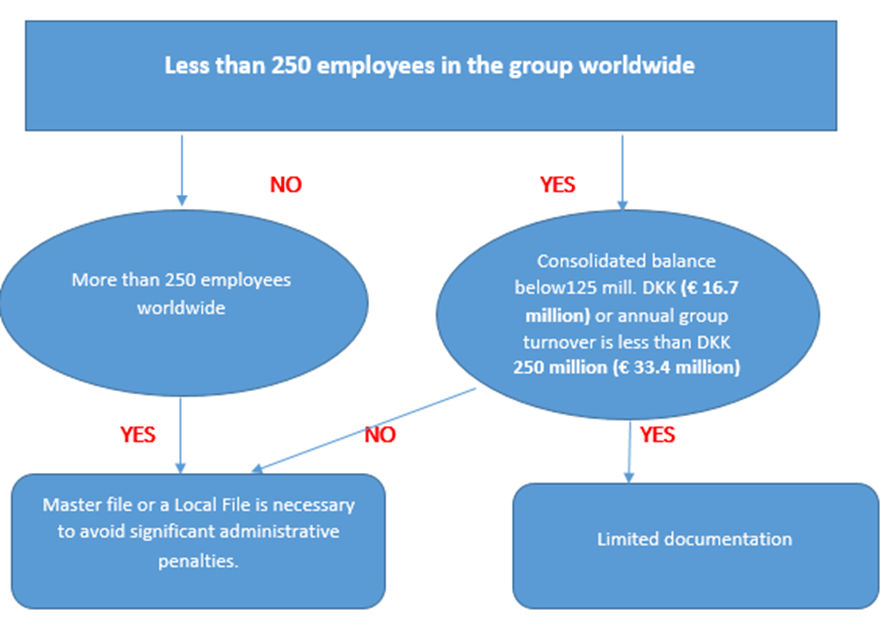

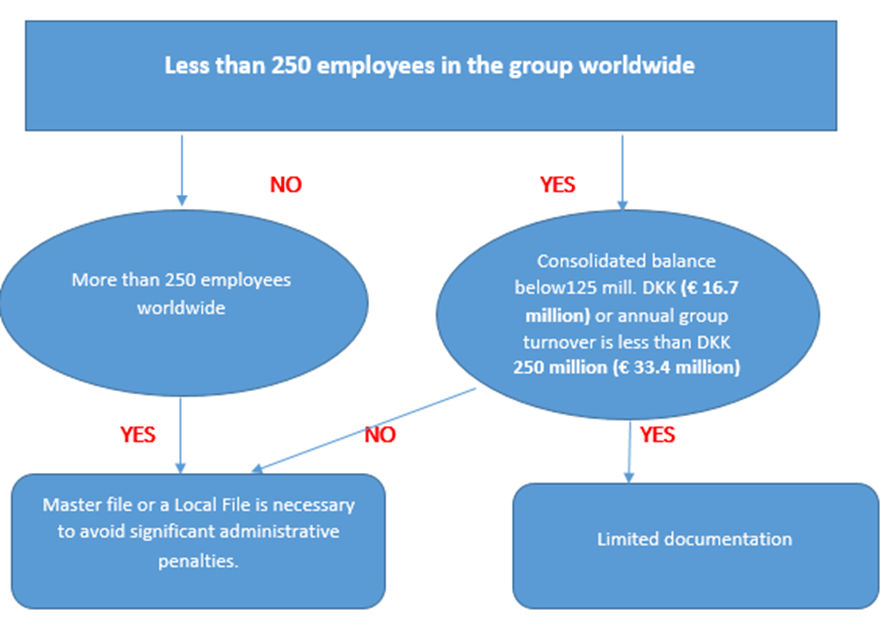

Transfer Pricing Transactions Documentation Ecovis In Denmark

In this situation interest WHT is levied at 22.

Denmark israel tax treaty

. November 3 2009 Kuwait City Kuwait. The treaty was concluded in the Hebrew English and Danish languages. Relief according to DTTs may be claimed if their provisions are more favourable. 12 of the Protocol.In order to avoid this situation Denmark has signed many double tax treaties over the years. Tax treaties are agreements between two countries designed to prevent a resident of one state from double taxation. Denmark and the Republic of Austria with respect to Taxes on Income and on Capital Austria Original 25-05-2007 27-03-2008 Amending 16 -09 2009 01 05 2010 4 Convention between the Kingdom of Denmark and the Peoples Repu li of Bangladesh for the Avoidance of Dou-ble Taxation and the Prevention of Fis-cal Evasion with respect to Taxes on In-. Tax treaties are usually constructed in order to incentivize foreign investments and international trade as well as.

See list of Belgian tax treaties. We advise the Government on international tax issues and are involved with the development and implementation of New Zealands international tax legislation. An individual resident in Denmark is entitled to deduct foreign income taxes paid or accrued on foreign-source income from the Danish tax payable up to a maximum of Danish tax paid on that part of the taxable income that is foreign-source income. February 21 1984 Seoul Korea.

Once in force the new treaty will replace the Denmark-Israel income and capital tax treaty of 27. The Deloitte International Tax Source DITS is an online database featuring tax rates and information for more than 60 jurisdictions worldwide and country tax highlights for more than 130 jurisdictions. Withholding tax on dividends interest and royalties under tax treaties. December 9 2006 Manila Philippines.

Danish Ministry Of Taxation Admits Defeat In Important Transfer Pricing Case Mne Tax. Tax Information Exchange Agreement TIEA AGREEMENT FOR AVOIDANCE OF DOUBLE TAXATION AND PREVENTION OF FISCAL EVASION WITH ARGENTINA Whereas an Agreement between the Government of the Republic of India and the. See recent changes for the latest updates made to tax treaties pages last updated on 15. DITS includes current rates for corporate income tax.

Denmark - Tax Treaty Documents The complete texts of the following tax treaty documents are available in Adobe PDF format. Denmark israel tax treaty. Treaty between Denmark and Israel details. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

These treaties stipulate the way the capital and the income are taxed and the rates of the withholding taxes on dividends interest and royalties. Denmark - Faroe Islands - Finland - Iceland - Norway - Sweden Income and Capital Tax Treaty Nordic Convention 1996 Art. FAQs INFORMA programme Registration of representative powers. See list of Danish tax treaties.

Belgium - Netherlands Income and Capital Tax Treaty 2001 Art. Israel is a signatory to a Treaty for the Prevention of Double Taxation with 37 countries all over the world. Meaning paying tax in the country where he made income or profits as well as the country where he resides. Interest is generally not subject to WHT unless paid to a foreign group member company that is tax resident outside the European Union and outside any of the states with which Denmark has concluded a tax treaty.

Relief at source for non-Danish entities is only available when the Parent-Subsidiary Directive applies in which case the participation exemption implies that no WHT is due 0 rate or if a Danish tax exemption certificate has been issued to the payee available for. Of the Kingdom of Denmark for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on Denmark Original 09-09-2009 29-12-2011 13 Convention between the Republic of Estonia and the State of Israel for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. The new tax treaty the Convention between the Government of Australia and the Government of the State of Israel for the Elimination of Double Taxation with Respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance and its associated Protocol was signed on 28 March 2019 in Canberra by the Assistant Treasurer the Hon Stuart Robert MP. I of the Protocol and Art.

The general withholding tax WHT rate is 27 percent. In the case of divergence however the English text prevails. February 13 1980 Tokyo Japan. See list of French tax treaties.

The treaties function to prevent double taxation by guaranteeing that the investors state of residence will provide either a tax credit for tax which has been paid in Israel or alternatively that the Israel sourced income will be exempt from tax in Israel or in the country of residence of the foreign investor. France - Spain Income and Capital Tax Treaty 1995 Art. Value added taxgoods and services tax. It has been reported that as part of the Israeli Ministry of Finances policy to renew Israels tax treaties with important OECD member countries Israel and Denmark recently signed a tax treaty.

Foreign tax relief. Certain other exemptions apply mainly relating to CFC taxation. Under most tax treaties the rate is reduced to 15 percent via reclaim. Treaty between Israel and Denmark signed and details.

II of the Protocol. Details of the income tax treaty and protocol between Denmark and Israel signed on 9 September 2009 have become available. December 5 1980 Rome Italy. June 9 1992 Manila Philippines.

Https Www Dlapiper Com Media Files Insights Publications 2018 06 Apa Map Guide Apa Map Guide Denmark Pdf La En Hash B17ffc044b8bf2a856c584d7d7f38331fb4f54f1 Hash B17ffc044b8bf2a856c584d7d7f38331fb4f54f1

Why Danes Appreciate The High Danish Income Tax Rate Iris Fmp

Double Taxation Ecovis In Denmark

Danish High Court Landsretten Issues Two Rulings In Beneficial Ownership On Dividends Wts Global

Https Assets Kpmg Content Dam Kpmg Xx Pdf 2020 08 Denmark Country Profile 2020 Pdf

Https Www Oecd Org Tax Dispute Denmark Dispute Resolution Profile Pdf

New Model For Dividend Taxation In Denmark Wts Global

Double Taxation Ecovis In Denmark

The general withholding tax WHT rate is 27 percent. An individual resident in Denmark is entitled to deduct foreign income taxes paid or accrued on foreign-source income from the Danish tax payable up to a maximum of Danish tax paid on that part of the taxable income that is foreign-source income.

Double Taxation Ecovis In Denmark

We advise the Government on international tax issues and are involved with the development and implementation of New Zealands international tax legislation.

Denmark israel tax treaty

. Tax Information Exchange Agreement TIEA AGREEMENT FOR AVOIDANCE OF DOUBLE TAXATION AND PREVENTION OF FISCAL EVASION WITH ARGENTINA Whereas an Agreement between the Government of the Republic of India and the. Israel is a signatory to a Treaty for the Prevention of Double Taxation with 37 countries all over the world. In order to avoid this situation Denmark has signed many double tax treaties over the years. Under most tax treaties the rate is reduced to 15 percent via reclaim.France - Spain Income and Capital Tax Treaty 1995 Art. In the case of divergence however the English text prevails. I of the Protocol and Art. The new tax treaty the Convention between the Government of Australia and the Government of the State of Israel for the Elimination of Double Taxation with Respect to Taxes on Income and the Prevention of Tax Evasion and Avoidance and its associated Protocol was signed on 28 March 2019 in Canberra by the Assistant Treasurer the Hon Stuart Robert MP.

See recent changes for the latest updates made to tax treaties pages last updated on 15. November 3 2009 Kuwait City Kuwait. Interest is generally not subject to WHT unless paid to a foreign group member company that is tax resident outside the European Union and outside any of the states with which Denmark has concluded a tax treaty. 12 of the Protocol.

Certain other exemptions apply mainly relating to CFC taxation. December 9 2006 Manila Philippines. Treaty between Israel and Denmark signed and details. Meaning paying tax in the country where he made income or profits as well as the country where he resides.

Foreign tax relief. See list of Belgian tax treaties. The treaty was concluded in the Hebrew English and Danish languages. Treaty between Denmark and Israel details.

Denmark - Faroe Islands - Finland - Iceland - Norway - Sweden Income and Capital Tax Treaty Nordic Convention 1996 Art. Relief at source for non-Danish entities is only available when the Parent-Subsidiary Directive applies in which case the participation exemption implies that no WHT is due 0 rate or if a Danish tax exemption certificate has been issued to the payee available for. FAQs INFORMA programme Registration of representative powers. See list of Danish tax treaties.

Tax treaties are usually constructed in order to incentivize foreign investments and international trade as well as. Denmark - Tax Treaty Documents The complete texts of the following tax treaty documents are available in Adobe PDF format. Denmark and the Republic of Austria with respect to Taxes on Income and on Capital Austria Original 25-05-2007 27-03-2008 Amending 16 -09 2009 01 05 2010 4 Convention between the Kingdom of Denmark and the Peoples Repu li of Bangladesh for the Avoidance of Dou-ble Taxation and the Prevention of Fis-cal Evasion with respect to Taxes on In-. February 21 1984 Seoul Korea.

Tax treaties are agreements between two countries designed to prevent a resident of one state from double taxation. December 5 1980 Rome Italy. February 13 1980 Tokyo Japan. Details of the income tax treaty and protocol between Denmark and Israel signed on 9 September 2009 have become available.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. See list of French tax treaties. Denmark israel tax treaty. II of the Protocol.

June 9 1992 Manila Philippines. DITS includes current rates for corporate income tax. Once in force the new treaty will replace the Denmark-Israel income and capital tax treaty of 27. Relief according to DTTs may be claimed if their provisions are more favourable.

The Deloitte International Tax Source DITS is an online database featuring tax rates and information for more than 60 jurisdictions worldwide and country tax highlights for more than 130 jurisdictions. Of the Kingdom of Denmark for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on Denmark Original 09-09-2009 29-12-2011 13 Convention between the Republic of Estonia and the State of Israel for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income. These treaties stipulate the way the capital and the income are taxed and the rates of the withholding taxes on dividends interest and royalties. The treaties function to prevent double taxation by guaranteeing that the investors state of residence will provide either a tax credit for tax which has been paid in Israel or alternatively that the Israel sourced income will be exempt from tax in Israel or in the country of residence of the foreign investor.

It has been reported that as part of the Israeli Ministry of Finances policy to renew Israels tax treaties with important OECD member countries Israel and Denmark recently signed a tax treaty. Withholding tax on dividends interest and royalties under tax treaties. Value added taxgoods and services tax. Belgium - Netherlands Income and Capital Tax Treaty 2001 Art.

Danish Ministry Of Taxation Admits Defeat In Important Transfer Pricing Case Mne Tax.

Transfer Pricing Transactions Documentation Ecovis In Denmark

Https Www Dlapiper Com Media Files Insights Publications 2018 06 Apa Map Guide Apa Map Guide Denmark Pdf La En Hash B17ffc044b8bf2a856c584d7d7f38331fb4f54f1 Hash B17ffc044b8bf2a856c584d7d7f38331fb4f54f1

Https Www Oecd Org Tax Dispute Denmark Dispute Resolution Profile Pdf

Why Danes Appreciate The High Danish Income Tax Rate Iris Fmp

Danish High Court Landsretten Issues Two Rulings In Beneficial Ownership On Dividends Wts Global

Https Assets Kpmg Content Dam Kpmg Xx Pdf 2020 08 Denmark Country Profile 2020 Pdf

Posting Komentar untuk "Denmark Israel Tax Treaty"